Loan Broker Example

Version 3.3.1 only

This Mule ESB example application demonstrates the power of content-based routing in Web service integrations.

Based on the Loan Broker Example included in chapter nine of Enterprise Integration Patterns: Designing, Building, and Deploying Messaging Solutions (Hohpe, Woolf, 2004), this application minimizes a borrower’s work in acquiring the best interest rate for a loan.

Loan Broker exposes a Web service that processes end user requests for interest rate quotes from banks. From a Web browser, an end user submits a request which contains the following:

-

borrower’s name

-

amount of the loan

-

repayment term of the loan

-

borrower’s social security number (SSN)

Mule ESB’s Loan Broker application accesses other Web services to process the request, then responds to the end user. The response identifies the bank name and interest rate of the lowest quote.

The Loan Broker Web service uses four elements to maximize its processing efficiency:

-

Choice Flow Controls to route messages based on content

-

Transformers to convert message payloads’ data format

-

Message Enrichers to add to, rather than change, message payloads

-

Foreach to iteratively, and synchronously, process message payloads

-

Dynamic Endpoints to send requests to different banks depending on the message payload

This example should help you to make informed decisions about using the four above-listed elements in your Mule applications. To understand more about Mule ESB’s ability to integrate services and systems, access the Mule examples and see other applications in action.

Assumptions

This document assumes that you are familiar with Mule ESB and the Mule Studio interface. To increase your familiarity with Studio, consider completing one or more Mule Studio Tutorials.

This document describes the details of the example within the context of Mule Studio, Mule ESB’s graphical user interface (GUI). Where appropriate, the XML configuration follows the Studio interface screenshot in an expandable section.

Set Up

As with this Loan Broker example, you can create template applications straight out of the box in Mule Studio or Mule Standalone (Mule ESB without Studio). You can tweak the configurations of these use case-based templates to create your own customized applications in Mule.

Follow the procedure below to create, then run the Loan Broker application in Mule ESB.

-

Complete the procedure in Examples and Exercises to create, then run the Loan Broker template in Mule Studio, or the Loan Broker example in Mule Standalone (Mule ESB without Studio).

-

Open your Web browser.

-

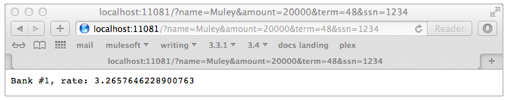

Type

http://localhost:11081/?name=Muley&amount=20000&term=48&ssn=1234into the address bar of your browser, then press enter to elicit a response from the Loan Broker application (below).

-

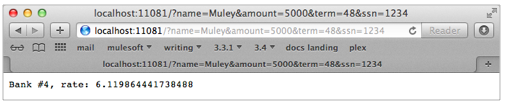

In your browser’s address bar, replace the

amountvalue with5000, then press enter to elicit a new response from the application (below).

How it Works

The Loan Broker application consists of several flows and subflows. These flows integrate Web services to process end user requests for interest rate quotes from banks.

The sections below offer flow-by-flow descriptions of the Loan Broker’s actions as it processes end user requests.

|

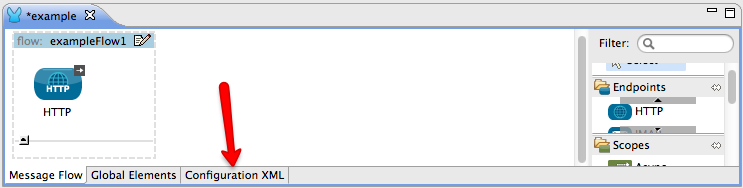

For Mule Studio Users In Mule Studio, double-click a building block to open its Properties Panel, then examine its configuration details. Alternatively, click the Configuration XML tab to examine the application’s XML configuration file.

|

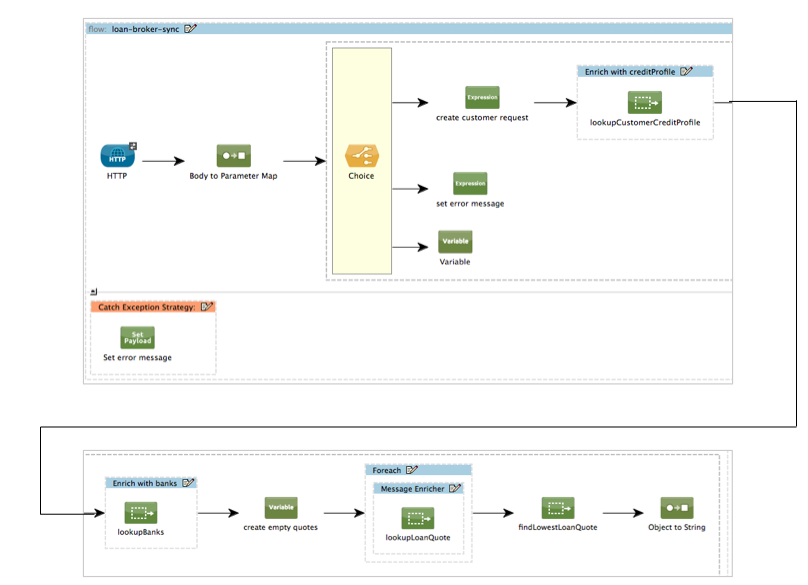

Loan-broker-sync Flow

As the main flow in the Loan Broker application, this flow coordinates data collection among flows to produce an end user response.

The request-response HTTP Inbound Endpoint in this flow receives an end user request. Because it has a two-way message exchange pattern, this HTTP endpoint is responsible for both receiving and returning messages.

|

Two-Way vs. One-Way Notice that the HTTP endpoint has a two-way message exchange pattern (as indicated by the small double-arrow icon — below, left). Because it must respond to the requester, the HTTP endpoint in this example has a request-response message exchange pattern. If an HTTP endpoint has only to input information into an application, it requires a one-way message exchange pattern (below, right).

|

Next, the Body to Parameter Map Transformer converts the data format of the message payload from HTTP body data to a Java map. The Loan Broker application only processes Java message payloads.

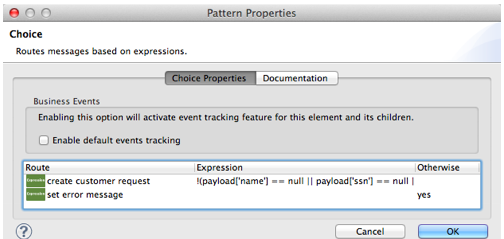

Then, Mule employs a content-based router to direct the message for further processing. The Choice Flow Control routes each message to one of two processing pathways according to its payload contents.

-

If the message payload contains a complete request (i.e. the borrower’s name and SSN, and the amount and the term of the loan), the choice flow control passes the message to the

create customer requestExpression Component. -

If the message payload is an incomplete request, the choice flow control passes the message to the

set error messageexpression component. This component sets the payload of the message to readError: incomplete request. Mule processes the message no further. Instead, it responds to the end user with the error message.

The create customer request component uses expressions to extract data from the message payload. It uses the data to create a new Java object with three values:

-

the

Customer, which identifies both the borrower’s name and SSN -

one

Integer, which identifies the amount of the loan -

a second

Integer, which identifies the loan repayment term

With a new CustomerQuoteRequest object in its payload, the message encounters its first Message Enricher. Throughout this flow, Mule enriches messages with data rather than changing the payload contents. By enriching a message, Mule preserves the payload content so that other elements in the application can access the original data.

The Enrich with creditProfile enricher contains only a Flow Reference Component. This type of component invokes other flows, or subflows, in the application to acquire, then add data to the message. In this case, the lookupCustomerCreditProfile component demands that the LookupCustomerCreditProfile subflow access an external Web service to acquire the borrower’s credit score. Mule enriches the message with the credit score, then passes the message to the next enricher in the flow.

As with its predecessor, the Enrich with Banks enricher uses a flow reference component to invoke a subflow and acquire data. In this case, instead of adding a credit score, Mule uses the result of the LookupBanks subflow to add a list of banks to the message payload.

Mule then uses a Variable Transformer to create an empty list variable. Mule will fill this empty quotes list variable with the quotes it fetches from banks. With an empty list to fill, the message next encounters a Foreach scope. One by one, this iterative processor fetches data to populate each item on the list.

To fetch these data, the flow reference component first invokes the LookupLoanQuote subflow to acquire a quote from a bank. Then, the message enricher adds the quote to the list variable. Foreach continues to invoke, then enrich, until it has acquired a quote from each bank on the list of banks. Foreach then passes the message to the next message processor in the flow.

To illustrate foreach’s behavior with an example, imagine a message payload with the following contents:

-

an empty

quoteslist variable -

a

bankslist variable naming two banks from which Mule must request a quote: MuliNational Bank, and IndustrialGrowth Bank

Foreach processes the message payload as follows:

-

Foreach consults the

bankslist variable to learn that it should send its first request to MuliNational. -

Foreach invokes the LookupLoanQuote subflow.

-

The LookupLoanQuote subflow calls the

getLoanQuoteWeb service to obtain an interest rate quote from MultiNational. -

The LookupLoanQuote subflow provides the Web service response to the Loan-Broker-Sync flow.

-

The message enricher inserts the interest rate quote from MultiNational into the

quoteslist variable. -

Foreach consults the

bankslist variable to learn that it should send its second request to IndustrialGrowth. -

Foreach invokes the LookupLoanQuote subflow.

-

The LookupLoanQuote subflow calls the

getLoanQuoteWeb service to obtain an interest rate quote from IndustrialGrowth. -

The LookupLoanQuote subflow provides the Web service response to the Loan-Broker-Sync flow.

-

The message enricher inserts the interest rate quote from IndustrialGrown into the

quoteslist variable. -

Foreach consults the

bankslist variable to find no more items on the list. It passes the message — now with a list containing two interest rate quotes — to the next message processor. Refer to the table below for a before-and-after comparison of message contents.Message Contents Before

Iterative ProcessingMessage Contents After

Iterative Processingbankslist variable:

• www.multinational.com/loans/quotes

• www.industrialgrowth.com/loans/quotesbankslist variable:

• www.multinational.com/loans/quotes

• www.industrialgrowth.com/loans/quotesquotelist variable:quotelist variable:

• 6.99

• 6.84

The penultimate message processor in this flow references yet another subflow in the application. The findLowestLoanQuote subflow determines which quote in the list is the lowest, then logs the result in the message payload.

Finally, the Object to String Transformer converts the message payload’s data format from Java to a string. The HTTP endpoint sends the response to the end user.

Notice that the Loan-broker-sync flow also contains a Catch Exception Strategy. Rather than use Mule’s default exception strategy this flow uses a customized exception strategy to handle errors. If an error occurs in the flow, the exception strategy’s Set Payload Transformer sets an error message on the payload. The application sends this error message, which reads, Error processing loan request, as a response to the end user.

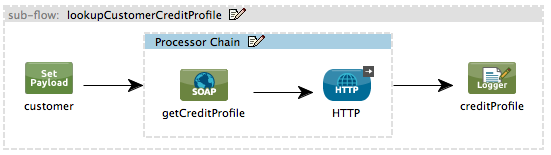

LookupCustomerCreditProfile Subflow

Invoked upon demand by the Loan-broker-sync flow, this subflow acquires and logs the borrower’s credit score on the message payload.

To acquire the credit score, the customer transformer sets the payload to Customer, as defined by the create customer request expression transformer. (Recall that the Customer variable contains the borrower’s name and SSN.) Mule sends a request to the getCreditProfile SOAP Web service. The HTTP endpoint inserts the Web service’s response into the subflow.

Mule leverages Apache’s CXF framework to build Web services. The Processor Chain that wraps the SOAP Component and HTTP outbound endpoint is a CXF requirement. It ensures that Mule completes all processing activities prior to logging the processing result.

Last in this flow, the Logger Component logs the payload of the Web service’s response on the message payload as the Credit Profile.

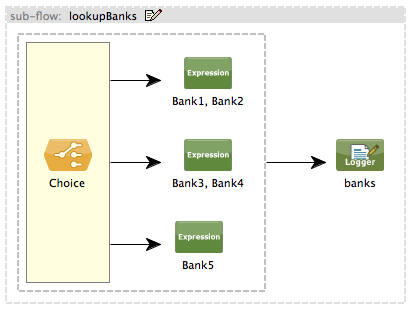

LookupBanks Subflow

The Loan Broker application prevents exposing all banks to all loan quote requests. A bank that caters to premiere clients, for example, would be irked to receive a request for a quote for a small loan from a borrower with poor credit. To prevent such irksome calls to banks’ Web services, the Loan Broker application employs the LookupBanks subflow.

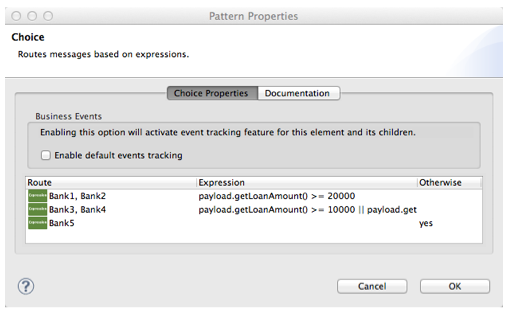

Mule first uses a choice flow control to examine the amount in the payload, then routes the message according to the size of the loan.

-

If the loan is more that $20,000, the flow control routes the message to the first expression component, labeled

Bank 1, Bank 2. -

If the loan is more than $10,000, the flow control routes the message to the second expression component, labeled

Bank 3, Bank 4. -

if otherwise (i.e. if the loan is $10,000 or less), the flow control routes the message to the third expression component, labeled

Bank 5.

Note that the choice flow control directs the message to the first expression that evaluates to true. For example, it directs a quote request for a loan of $30,000 only to the Bank 1, Bank 2 component.

Each expression component in this subflow contains the URIs of the banks willing to provide an interest rate quote. For example, messages that pass into the Bank 3, Bank 4 component earn, as a payload addition, the URIs for Banks 3 and 4. The banks Logger component records the list of appropriate banks to which to send a request.

LookupLoanQuote Subflow

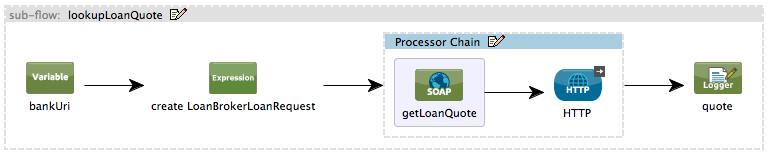

This sends a quote request to banks' Web services.

First, the variable transformer stores the Mule message payload — the bank’s URI — as a variable named bankUri. (Recall that this subflow receives requests one at a time from foreach in the Loan-broker-sync flow. Each request’s payload a the URI of a bank.)

The create LoanBrokerLoanRequest component uses expressions to extract the borrower’s credit profile (logged by the creditProfile logger in the LookupCustomerCreditProfile flow) from the message payload. It uses the data to create a request to send to the getLoanQuote Web service.

Mule uses a SOAP component — configured as a JAXWS-client — to send the request to a bank’s Web service. The HTTP outbound endpoint dynamically determines where to send the request based on the bank’s URI in the message payload. It receives the response from the banks’ Web service and pushes the response payload to the quote logger to record.

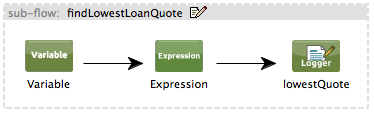

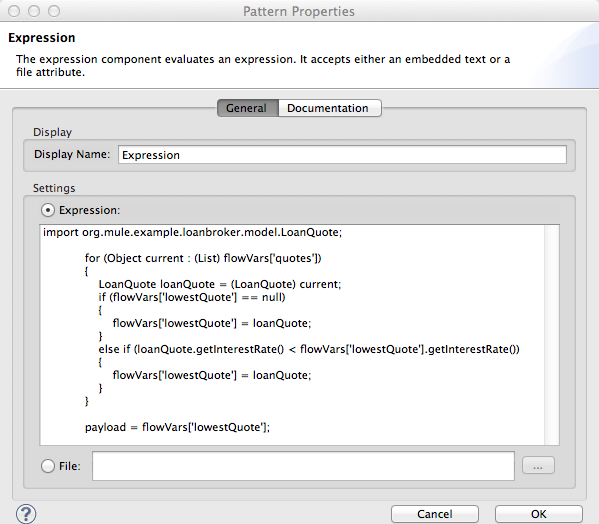

FindLowestLoanRequest Subflow

This simple subflow uses an expression component to determine which item, in the list of quotes, offers the lowest interest rate. The Logger records the result.

The expression in the component compares the getInterestRate of items in the list to each other to determine which one is the lowest (see image below).

Mock Flows

The remaining six flows in the Loan Broker application are “mock flows”. They act as external Web services to which the five legitimate flows and subflows call to request data.

Each flow contains:

-

a request-response HTTP Endpoint and SOAP component to receive the requests

-

a Java Component which produces random data to mimic Web service processing.

You do not need to include these flows your customized application; they exist in the Loan Broker example only to support a functional example.

Related Topics

-

For more information on routing messages, see Choice Flow Control.

-

For more information on enriching messages, see Studio Scopes.

-

For more information on setting variables on messages, see Variable Transformer Reference.

-

For more information on iterative processing, see Foreach.

-

For more information on applying exception strategies to flows, see Error Handling.

-

For more information on configuring a SOAP component, see SOAP Component Reference.